We are the future

of digital marketing

The way the financial sector works is changing. So too are customers, including in how and where they engage and communicate with their friends and with brands.

At TINK, we want to help you handle this evolution and turn a challenge into an opportunity. By relying on our solutions, you can reach more customers on the channels they use and earn their loyalty – before leveraging this loyalty to attract new customers.

Financial marketing:

Driving your revenues!

At TINK, we create referral marketing solutions specifically designed to boost customer retention and leverage customer loyalty to drive sales. As a financial institution, incentivising your customers to recommend you to others creates word-of-mouth marketing with an added element of trust. Our focus on the human element of marketing, on testimonials and trust, allows us to drive revenues.

Transform your marketing and make waves in the financial sector!

Our solutions attract customers and earn their loyalty

Integrated

Our solutions blend seamlessly with your company’s existing digital presence. We adapt our marketing software to your specific digital environment of APIs and web services and strive to improve your digital marketing strategy.

Transformational

New online sales systems (such as click-to-chat and click-to-call functions) have added digital, social elements to financial services marketing. We embrace such developments, which significantly improve the customer experience.

Agile

We conduct exhaustive analysis to determine the RoI for each campaign. This ensures we react rapidly, implement changes where needed and define clear strategies to achieve KPI targets.

TINK campaigns

take on a life of their own.

Our customer referral programme specifically tailored to banks and other financial institutions enables your customers to enjoy a share of the commercial benefits of recommending you and your products. Leveraging customer loyalty in this way refreshes your marketing activities and cuts customer acquisition costs in half.

We adapt our offering to your existing technical setup and provide solutions to support the digital transformation in your company. With our innovative tool, profound expertise and experience in the finance industry, we are ideally positioned to create highly effective strategies to promote your products – from current accounts and credit cards to mortgages and insurance policies.

Ready to boost your sales?

Getting started with us couldn’t be easier.

Our experience

is your solution.

Case Studies

THE CLIENT

Our client was a consolidated financial institution in the Spanish-speaking world with an extensive domestic and international network of branches, ATMs and other digital distribution channels.

It offers its services to large corporations, SMEs and private customers. In recent years, this institution has pursued an innovative, digitalised approach and is currently implementing the final stage of its digital transformation project.

THE CHALLENGE

One of our client’s most pressing needs was to find new distribution channels to stand out from its competitors in the world of online finance while simultaneously complementing existing channels. In this case, the specific challenge lay in developing a digital marketing campaign that would enable the institution to increase its digital sales exponentially in a straightforward, cost-effective and quick-to-implement process.

THE SOLUTION

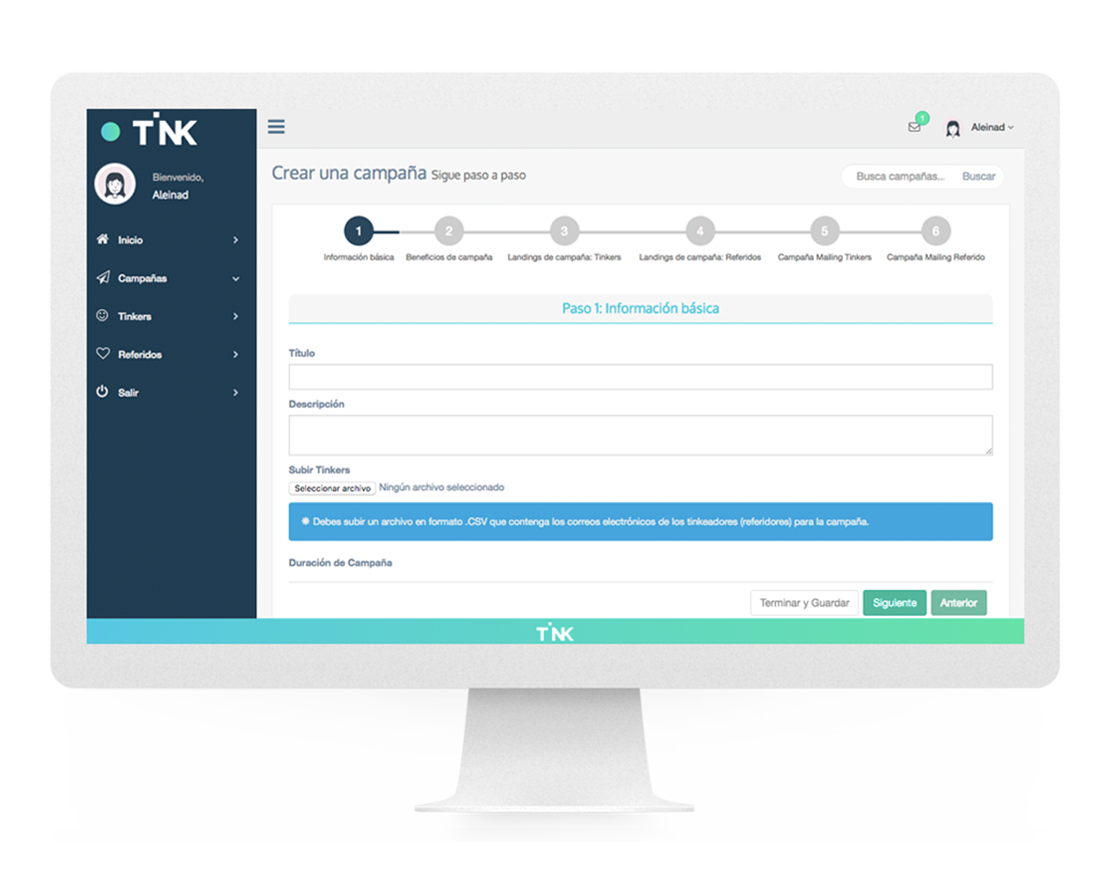

In the end, the institution opted to integrate our Referral-as-a-Service software into its digital marketing strategy. Our solution is fully customisable and blended seamlessly with the banking institution’s existing digital offering. By evaluating analytics and conducting A/B testing, we optimised the institution’s referral marketing campaign until the new customer-to-customer sales channel was fully consolidated.

Read more about the pillars of our campaigns

RESULTS

conversion rate

increase

increase in sales

generated by Tink

reduction in digital

customer acquisition cost

We know what your bank needs!

Frecuently asked questions

- Mostrar todo

- Ocultar todo